Have you ever taken a deep dive into how health insurance works? I know I didn’t for quite a while, as it just seemed like a necessary part of life.

Let’s simplify it: if you go the traditional route, you pay a monthly premium to cover the routine costs of your insurance company.

According to the Affordable Care Act marketplace on Healthcare.gov, the average premium ranges from $407 to $1,224 per month.

Keep in mind, this premium doesn’t count towards your deductible or out-of-pocket maximum.

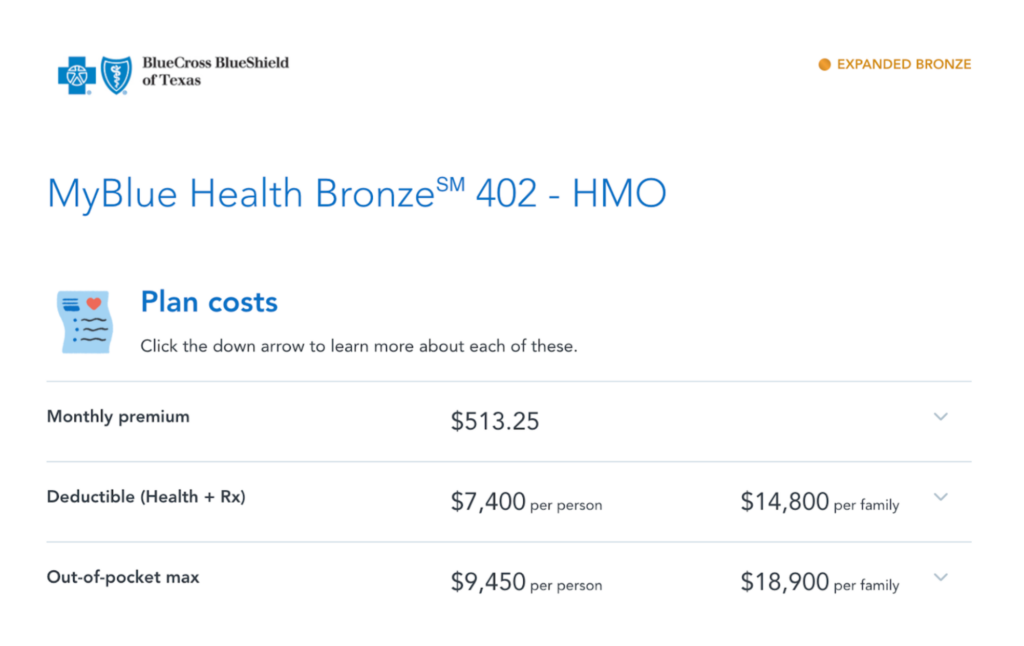

I went ahead and did a little research for you by pretending to sign up for Blue Cross Blue Shield (BCBS) of Texas, just to get some real numbers based on my zip code:

Then you have a deductible which is how much you have to pay in medical expenses every year before the insurance company will contribute a dime. According to the IRS, your deductible can be anywhere between $1,400 to $7,050.

Even after hitting your deductible, you’re still on the hook for coinsurance—where you split the cost of health care services with your insurance company. For instance, your insurer might cover 80%, leaving you to cover the remaining 20% until you hit your plan’s out-of-pocket maximum.

Then there’s the copay, which you cover in full for each provider visit until you reach your out-of-pocket maximum.

Here’s the breakdown from Blue Cross Blue Shield of Texas on what my financial responsibility would look like before and after meeting the deductible (which, as a reminder, is $7,400 per person).

Let’s play pretend

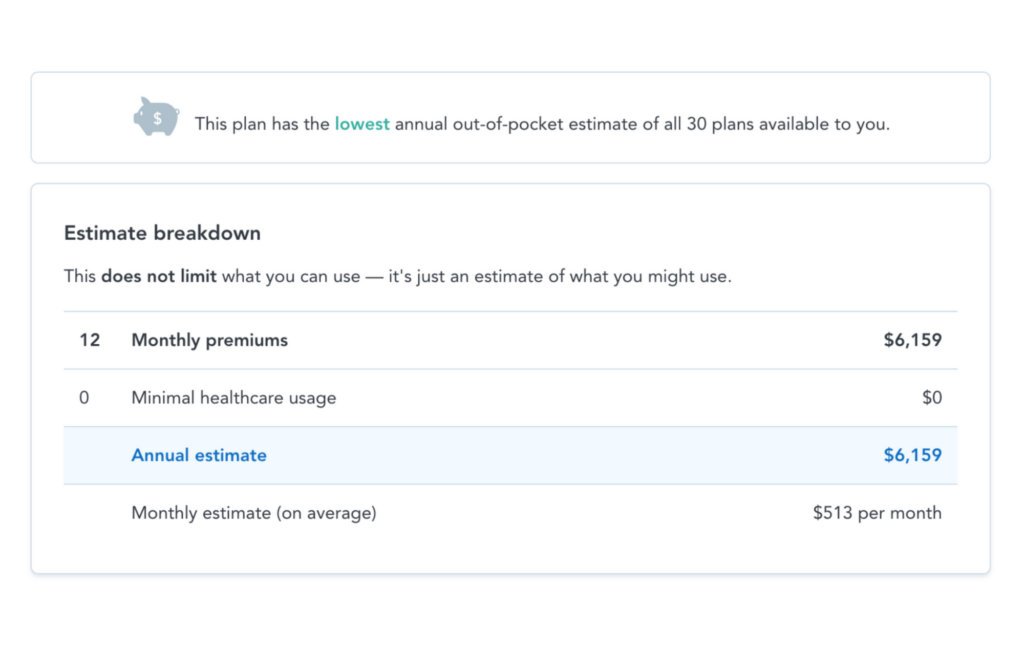

Suppose I sign up for BCBS of Texas at $513 per month. That adds up to $6,159 a year, solely covering the insurance company’s routine costs—not a dime of that goes toward my deductible.

So, according to BCBS of Texas, my deductible is $7,400 per person. This means I’d have to pay the annual premium of $6,159 plus $7,400 in medical expenses before my insurance even starts contributing with coinsurance. BCBS typically covers only about 40-50% of the bill after that.

And this is just for one person. If you add a spouse, the costs could double, and having a child or two will likely increase it even more. Remember, these companies are FOR PROFIT.

On top of that, I’m limited to which providers are in-network.

I never questioned health insurance—I assumed it was the only option…

That is, until I found Christian Healthcare Ministries (CHM), an alternative to traditional health insurance.

After thorough research, I chose to invest in our healthcare differently—aligning it more closely with my approach to and use of healthcare services.

Let me explain

We work hard to be healthy people. That means we aren’t going to conventional medical doctors regularly. We only step into that system if we have an emergency. So, we wanted a healthcare cost solution where we could freely choose our providers and services that work best for us (and keep healthy). We know we’re going to pay out-of-pocket for those extra (or potentially inelgible) expenses, but wanted to have sufficient emergency support with monthly costs that are cheaper than what we’d otherwise face with traditional health insurance companies. That’s where CHM comes in!

When my daughter was born four years ago, we had to pay entirely out of pocket for her home birth because our conventional health insurance wouldn’t cover it. I vividly recall needing a bag of IV fluids during my first trimester, and urgent care charged me $1,200 even with my insurance.

But now that I’m a CHM Gold member, 100% of my eligible bills will be reimbursed for prenatal care, home birth, midwives, postpartum care (including eligible physical therapy expenses), as well as up to $125,000 for any emergencies. As a health cost sharing ministry, not insurance, CHM equips my family with flexible programs that allow me to prioritize what matters most.

It feels like we’re getting the best of both worlds!

For my daughter and I with CHM’s Gold membership, we’re paying $480 a month ($240 per person), which is actually less than what we used to pay for just one person on conventional health insurance.

If you’re a parent with multiple children, there’s no need to worry. CHM simplifies things with a unit system. A single individual counts as one unit, a married couple as two units, and a family—no matter how many kids—as three units. So, if you’re married with five children, the most you’ll pay for CHM Gold is $240 per unit for 3 units, which totals $720 a month.

Christian Healthcare Ministries isn’t health insurance—it’s a health cost-sharing program within a biblical community, and it operates as a NONPROFIT.

Learn more by visiting Christian Healthcare Ministries.

© dr. courtney kahla | Legal | design by Intentionally Designed

not sure where to start on your wellness journey?

connect

resources

discover

take the quiz

navigate

Welcome

I’m Dr. Courtney Kahla. I’m here to empower you to take control of your own health & wellness.

start learning

the blog

I love to share what I’m learning about holistic wellness. Let these articles serve as a springboard for your own research!